What is FinOps? How It Helps Businesses Optimize Cloud Costs

Vaibhav Gramni

May 9, 2025

What is FinOps?

FinOps (Financial Operations) is a framework that promotes shared accountability for managing cloud infrastructure and costs. Following FinOps principles will help your financial, engineering, and operations teams collaborate and optimize their cloud spending, allowing you to derive the maximum value from cloud investments without disturbing your budgets. One such example is that of Adobe, which massively cut cloud costs post-FinOps implementation.

This blog will help you understand how to replicate their success.

Why is FinOps Important for Businesses To Optimize Cloud Costs with AI?

FinOps ensures your business can easily handle diverse AI workloads while avoiding extra costs. With real-time visibility and improved forecasting, you will know which resources are lying idle and still paying for them. Also, with cross-functional support from teams, you can be sure that value is derived from each dollar spent. This is why Spotify and Netflix abide by AI-based cloud FinOps and have saved millions by eliminating redundant cloud services and shutting down unused resources during lower activity periods.

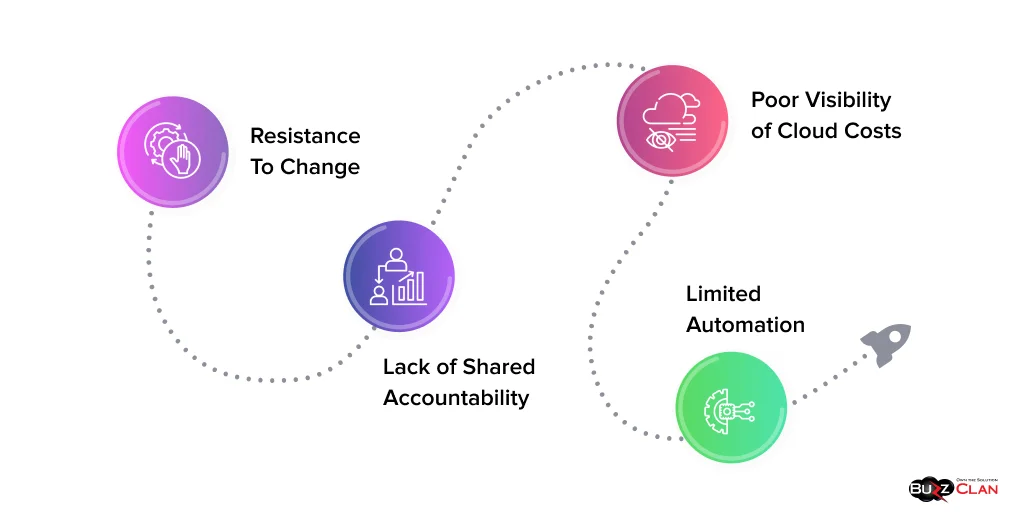

Challenges in Adopting FinOps and How to Overcome Them

While FinOps is an excellent initiative for your business, it is not free of challenges. All your stakeholders may agree to the changes, but the initiative will be less effective if you lack team support. Let’s look at the challenges you must overcome when adopting FinOps.

Resistance To Change

Seldom are people born geniuses! The same goes for the phase when a technology is implemented at the organizational level. Teams will need time to adapt to the new framework and grasp the architecture. However, don’t treat this as the end of the world. Take simple steps like organizing internal workshops for both tech and non-tech teams. Eventually, teams will get comfortable as they realize their workloads will reduce and not increase post-implementation. You can incentivize them and hold discussions to help them fully understand the impact.

Lack of Shared Accountability

Accountability becomes a significant concern when implementing FinOps. Cross-functionality is often missing in operations, finance, and engineering teams, and sharing cost ownership becomes a huge issue. First, you must create a team and help your employees understand the importance of shared accountability. Once they are well-versed, they can apply it in their regular practice.

Poor Visibility of Cloud Costs

Let’s face it: Cost reduction and anything substantial can be challenging without consistent tagging and limited insights! Remember that adopting FinOps practices will only benefit you when the entire organization is on the same page. So, with stringent tagging standards, real-time dashboards, and consolidated billing, ensure your employees invest their time in understanding cloud costs and FinOps best practices.

Limited Automation

Gone are the days when manual processes were trending and automation was feared! The business landscape evolves fast, and manual methods only lead to poor optimization and increased errors. With the right tools, you can be alerted beforehand, prevent shutdowns, and rightsize resources (allocate resources as per demand) like the back of your hand.

Implementing FinOps in Your B2B Organization

Let’s see how you can seamlessly integrate it into your organization.

- Firstly, you need to gather your engineering, product, operations, and finance teams and share the concept of shared accountability. This means all teams are responsible for their cloud cost spending and helping others do the same.

- The second step is to address the root cause. It is about using tools to understand cloud costs and achieve transparency. Once your team understands the basics, it is time to set budgets and allocate resources according to the team’s needs.

- Thirdly, you must conduct regular training and feedback sessions to ensure your teams do not face issues and make cost-effective decisions.

- The last step looks simple, but will require tremendous effort. It involves setting a culture of continuous improvement and applauding teams on the right track.

If you are still deciding whether FinOps implementation is worth it, these numbers will change your opinion!

| Industry | Before FinOps | After FinOps | Savings |

|---|---|---|---|

| Tech Startups | $100K/month on AWS | $75K/month on AWS | 25% savings |

| E-commerce Platforms | $200K/month on GCP | $150K/month on GCP | 25% cost reduction |

| Media Companies | $500K/month Azure | $400K/month Azure | 20% drop in storage costs |

| Large Enterprise | $2M/year across clouds | $1.6M/year | 20% savings |

| Fintech Companies | $90K/month (mostly idle resources) | $60K/month | 33% savings |

| Retail Chain (Cloud + Edge) | $800K/year | $680K/year | 15% savings |

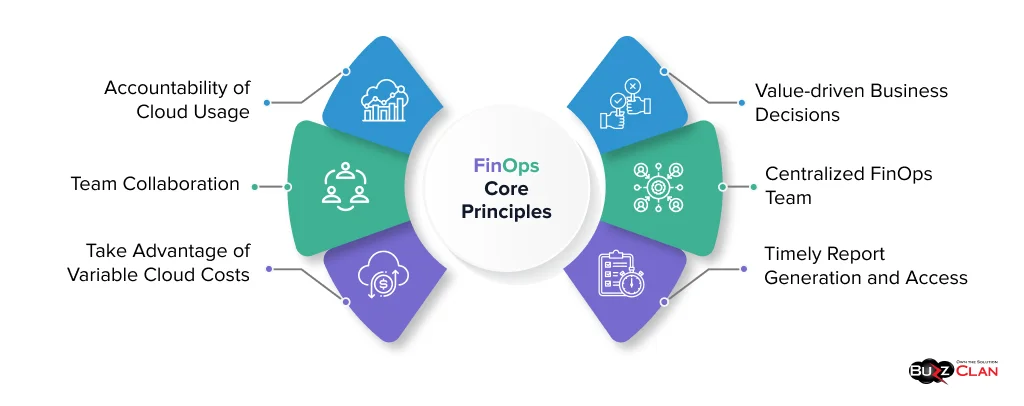

Core Principles of FinOps

Now that you are clear about implementing FinOps, let’s understand its principles.

- The finance, engineering, and operations teams must have a solid understanding and collaborate to optimize costs and bring about an organizational shift.

- Cloud accountability is necessary as all teams take ownership of their cloud usage.

- A centralized team helps implement best practices and suggests changes over time.

- All cloud spends have strategic goals behind them and drive ROI.

- Reports are accessible to key decision-makers and aid real-time decision-making.

- The flexibility and scalability offered by cloud models are analyzed and used for savings.

Further Reading

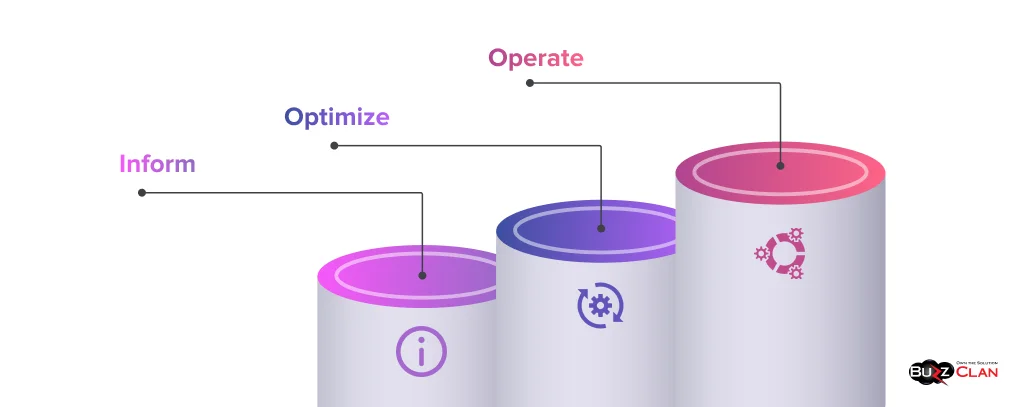

Core Pillars of FinOps

Here are the core pillars of FinOps. Following them will help you streamline implementation and adapt better.

Inform

Teams can make better decisions only when they know the intricacies of a new framework. FinOps is not about empowering a selected few in an organization; it is holistic and provides the tools and techniques required to make cost-effective decisions about cloud usage. For example, your company has a monthly cloud bill of $20,000. In that case, your IT team can determine what amount can be dedicated to external applications versus the ones used for internal purposes.

Optimize

The next pillar is all about hunting ways to save cloud spend. As per the data obtained by the Inform phase, areas where costs can be optimized are identified in the optimization stage. Is there a possibility of rightsizing resources and availing discounts? Are there any resources that can be eliminated? Let’s say you run virtual machines, which cost you $5 per minute. What you can do is research nodes that cost less, say $3 per minute, to save costs. However, you must consider licensing requirements and other aspects for the best benefits.

Operate

Optimizing cloud costs is not a one-and-done performance. Analyzing performance and improvisation is the key to nailing FinOps practices. The best way is to use automation once your optimization efforts align with your business goals. Not only will they alert you to anomalies, but they will also help you identify patterns and trends to achieve optimal performance. Besides, they will detail individual costs, and you will know exactly where to save!

Summing Up

FinOps lets you have the best of both worlds. Yes, flexibility and speed don’t come at the cost of visibility and control. Cloud cost management is no longer a pressing headache but a collaborative effort that aligns with your business values. It is safe to say that no one brings finance, operations, and technology together better than FinOps. Not only can you reduce wastage and optimize resources, but you can also make better decisions for your organization. It is time to realize that FinOps- as- a- Service is not just a medium boosting financial performance across the cloud but a lifesaver and a must-have for sustainable growth. The question is, when are you taking the plunge?

FAQs

Get In Touch